What is the digital-only type of account that Absa offers?

Quel type de compte 100 % numérique propose Absa ?

Absa offers the Absa Digi Account — a 100% digital bank account that lets you open, verify, and

start banking entirely online, without visiting a branch. It’s designed for convenience, speed, and

flexibility — open your account in minutes and manage everything through the Absa Mobile App

or Internet Banking

Absa propose le compte Absa Digi, un compte bancaire 100 % numérique qui vous permet d'ouvrir, de vérifier et

de commencer à effectuer vos opérations bancaires entièrement en ligne, sans vous déplacer en agence. Conçu pour plus de simplicité, de rapidité et de

flexibilité, il vous permet d'ouvrir votre compte en quelques minutes et de tout gérer via l'application mobile Absa

ou les services bancaires en ligne.

What is the eligibility to open an Absa Digi account ?

Quelle est l'éligibilité pour ouvrir un compte Absa

?

You can open an Absa account as long as:

Vous pouvez ouvrir un compte Absa aussi longtemps

que:

-

You are a Mauritian citizen or an expatriate

residing in Mauritius with a valid residence permit

Vous êtes résident à Maurice

-

You have a valid NIC or Passport number

Vous avez une carte d'identité ou un numéro de

passeport valide

-

You have a valid mobile number and an email

address

Vous avez un numéro de téléphone et une adresse

mail valides

-

You are 18 years of age or above

Vous avez 18 ans ou plus

-

You are a Tax Resident of Mauritius

Vous êtes résident fiscal de l'Ile Maurice

Do I need to visit a branch after applying for an Absa

Digi Account online ?

Dois-je me rendre dans une succursale après avoir fait la

demande en ligne pour un compte Absa ?

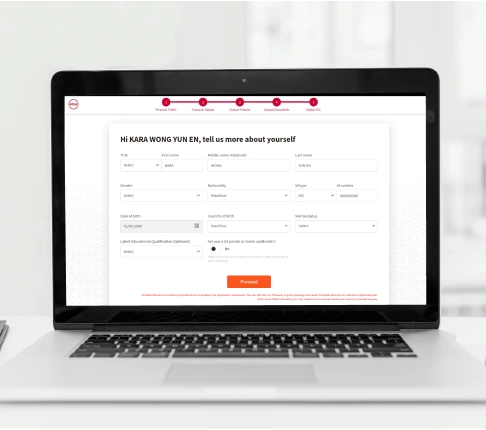

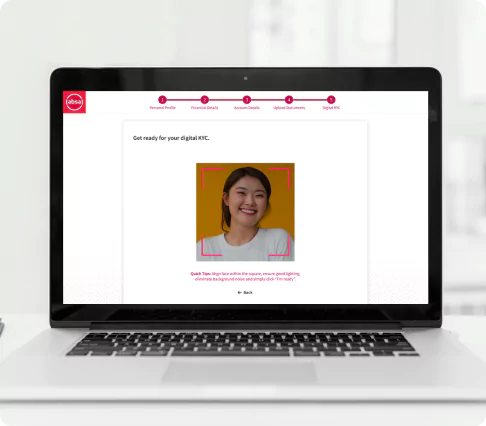

No, there is no need to visit a branch. While filling your application online, you will need to:

Non, il n'est pas nécessaire de vous rendre en agence. Pour remplir votre demande en ligne, vous devrez :

-

Enter your application details online .

Entrez les détails de votre

candidature en

ligne .

-

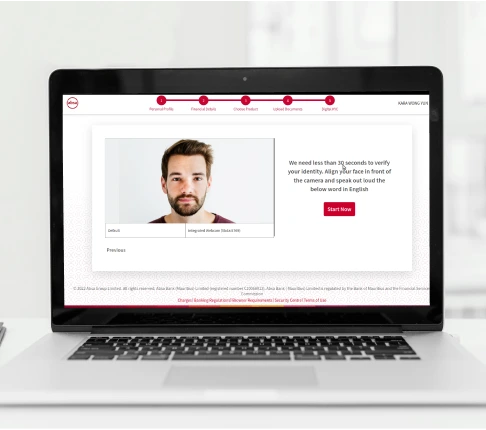

Complete your Digital KYC.

Complétez votre KYC

numérique.

-

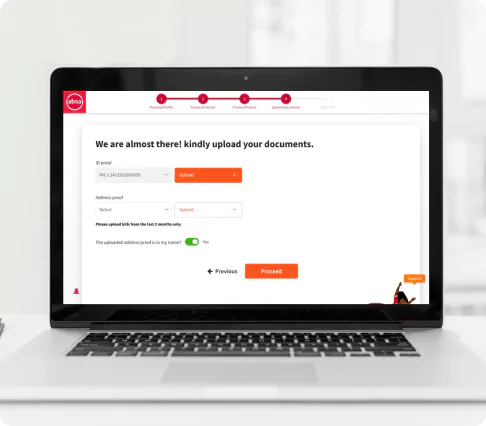

Upload your NIC/Passport and Address

proof.

Téléchargez votre carte

d'identité/passeport et

votre justificatif d'adresse.

Once you have filled the application online, you should receive your account number shortly, unless

there are additional queries from our side. Your welcome kit will be delivered to your preferred

address within 72 working hours (for domestic delivery).

Une fois la demande remplie en ligne, vous devriez recevoir votre numéro de

compte provisoire sous quelques heures. Pour activer votre compte et retirer

votre carte de débit dans n'importe quelle agence Absa, veuillez vous munir des

originaux de votre pièce d'identité et d'un justificatif de domicile que vous

avez téléchargés en ligne.

Pour les comptes Prestige, Premier et Young Pro, une fois votre dossier

rempli en ligne, notre Chargé de relation vous recontacte et fixe un

rendez-vous.

I have applied for an Absa Digi Account. What are the next steps and what is the

turnaround time for account activation ?

J'ai demandé un compte Absa. Quelles sont les prochaines étapes et quel

est le délai d'activation du compte ?

Once your online application is successfully completed, you should receive your provisional

account number, which will remain reserved for 30 days.

Une fois votre demande en ligne complétée avec succès, vous devriez recevoir votre numéro de compte provisoire,

qui restera réservé pendant 30 jours

If your application process takes longer than 30 days to be completed — for example, due to

discrepancies such as incorrect document uploads, pending video KYC, or other verification

issues — a new provisional account number will be issued, which will again remain valid for 30

days.

Si le traitement de votre demande prend plus de 30 jours — par exemple, en raison de

discrépances telles que des téléchargements de documents incorrects, une vérification d'identité vidéo en attente ou d'autres problèmes de vérification

— un nouveau numéro de compte provisoire sera émis, qui restera valable pendant 30

jours.

Your welcome kit, including your free Digi Debit Card, will be delivered to your preferred address

within 72 working hours (for domestic delivery). Once received, you can activate your debit card on

the Absa Mauritius Mobile App and start using your account.

Votre kit de bienvenue, comprenant votre carte de débit numérique gratuite, sera livré à l'adresse de votre choix

sous 72 heures ouvrables (pour une livraison en Indonésie). Dès réception, vous pourrez activer votre carte de débit

sur l'application mobile Absa Mauritius et commencer à utiliser votre compte.

Can I apply for the Absa Digi Account from my mobile ?

Puis-je demander le Compte Absa depuis mon mobile ?

Yes, our digital onboarding platform works on all devices including desktops,

laptops, mobile phones and tablets.

Oui, notre plateforme d'intégration numérique fonctionne sur tous les appareils,

y compris : les ordinateurs de bureau, les ordinateurs portables, les téléphones

mobiles et les tablettes.

Are there any documents that I need to keep handy before applying for an Absa Digi

account ?

Y a-t-il des documents que je dois garder à portée de main avant de demander un

compte Absa ?

Please keep the following documents handy while applying for your account

digitally.

Veuillez conserver les documents suivants à portée de main lors de la demande de

votre compte numériquement.

-

ID Proof - Your NIC (for citizens) or Passport

(for expat residents)

Preuve d'identité : votre

carte d'identité (pour

les citoyens) ou votre passeport (pour les résidents expatriés)

-

Proof of address – A recent bank statement or utility bill

Preuve d'adresse - Un relevé bancaire ou une facture de service public récente

-

Residence permit: (for expat residents)

Permis de séjour : (pour les résidents expatriés)

Please Note: The address proof should not be older than 3 months and should be in your name. If the address proof is not in your name, please upload additional documents like a birth certificate, marriage certificate, or rent agreement to establish relationship.

Attention : Le justificatif de domicile ne doit pas dater de plus de trois mois et doit être à votre nom. Si ce n'est pas le cas, veuillez fournir des documents supplémentaires tels qu'un acte de naissance, un certificat de mariage ou un contrat de location afin d'établir votre lien de parenté.

Can I hold my account jointly with another

applicant ?

Puis-je détenir mon compte conjointement avec un autre

demandeur ?

Unfortunately, the online account opening is intended for a single user only.You

can visit our branches to open an account jointly.

Malheureusement, l'ouverture de compte en ligne est destinée à un seul

utilisateur.

I got disconnected from the web page while filling in

the application form. How can I resume ?

J'ai été déconnecté de la page Web pendant que je

remplissais le formulaire. Comment puis-je reprendre ?

Don’t worry, we save all the information that you’ve

entered. You can resume your application from where you last left. To resume

your application,

Ne vous inquiétez pas, nous sauvegardons toutes les informations que vous avez

saisies. Vous pouvez reprendre votre candidature là où vous l'avez laissée pour

la dernière fois. Pour reprendre votre candidature,

Can I save my application and continue it later?

Puis-je enregistrer mon application et la poursuivre plus

tard ?

Yes, of course! All the information you’ve entered is backed up. You may leave

the application or close it at any point.

When you return, you can resume from where you left off.

Oui bien sûr! Toutes les informations que vous avez saisies sont sauvegardées.

Vous pouvez quitter l'application ou la fermer à tout moment. Lorsque vous

revenez, vous pouvez reprendre là où vous vous étiez arrêté.

Is my information secure?

Mes informations sont-elles sécurisées ?

The security of your personal information and your online

banking transactions is of utmost importance to us.

We maintain strict security standards to prevent unauthorized access to your

information.

La sécurité de vos informations personnelles et de vos transactions bancaires en

ligne est de la plus haute importance pour nous. Nous maintenons des normes de

sécurité strictes pour empêcher tout accès non autorisé à vos informations.

I do not have a NIC. Can I still apply for an Absa Digi

account ?

Je n'ai pas de carte idéntité. Puis-je encore demander un

compte Absa ?

Unfortunately, we need your NIC or Passport to open your

Absa Digi account.

Malheureusement, nous avons besoin de votre carte d'identité ou de votre

passeport pour ouvrir votre compte Absa.

When will I receive a chequebook for my online account

opening ?

Quand vais-je recevoir un chéquier pour mon ouverture de compte en ligne ?

Your account is fully digital and doesn’t include a chequebook (who uses them

anyways).

Votre compte est entièrement numérique et ne comprend pas de chéquier.

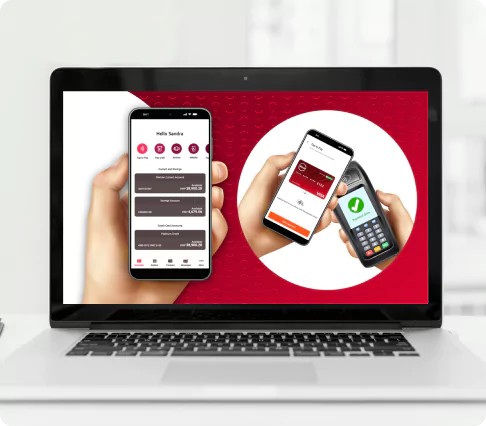

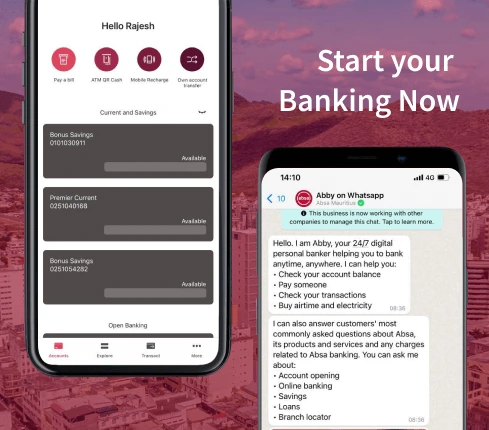

Your Digi Account is supercharged digitally with.

Votre compte Digi est suralimenté numériquement avec.

-

Absa Mauritius Mobile App (available on Android, iOS and

Huawei)

Application mobile Absa Mauritius (disponible sur Android,

iOS et Huawei)

-

Absa Internet Banking.

Services bancaires en ligne

Absa.

-

Abby at Branches.

Abby dans les succursales.

-

Abby on WhatsApp (Chat on 5919 0001).

Abby sur WhatsApp (Bank like you chat

on 5919 0001).

You can however request a chequebook via

Internet

Banking or at any Absa branch.

Vous pouvez toutefois demander un chéquier via

Internet Banking ou dans n'importe quelle agence Absa.

Please Note: The Chequebook will be charged Rs 5

per sheet

for a Digi Account and will be deducted directly from your account

once

dispatched.

There is no cost of chequebook associated with Young Pro, Prestige

and Premier

account.

Veuillez noter : le chéquier sera facturé Rs 5 par feuille pour un

compte Digi et sera déduit directement de votre compte une fois

expédié.

Who is a US Person ?

Qu'est-ce qu'une personne US ?

A US person (for tax purposes) is classified as any person who is either a United States Citizen, Legal Permanent Resident / Green Card Holder, or U.S. Visa holder. If you are a U.S. person, we are obliged to communicate this information to the U.S. Government irrespective of whether you reside in the United States or in a foreign country, or you are a Dual Citizen and/or Permanent Resident of a foreign country outside of the United States.

Aux fins fiscales, une personne américaine est définie comme toute personne qui est soit citoyen américain, soit résident permanent légal (titulaire d'une carte verte), soit titulaire d'un visa américain. Si vous êtes une personne américaine, nous sommes tenus de communiquer ces informations au gouvernement américain, que vous résidiez aux États-Unis ou à l'étranger, ou que vous possédiez la double nationalité et/ou soyez résident permanent d'un pays étranger.

My question is not listed here

Ma question n'est pas listée ici

If you have any further questions, we would be happy to

help you. You can reach us on 402 1000 (available 24 X 7). Alternatively,

there is a chat feature on your account opening

journey which you can use at your convenience to reach out to us.

Si vous avez d'autres questions, nous serons heureux de vous aider. Vous pouvez

nous joindre au 402 1000 (disponible 24 X 7). Alternativement, il existe

une

fonction de chat sur votre parcours d'ouverture de compte que vous pouvez

utiliser à votre convenance pour nous contacter.